Investing in insurance can offer higher returns compared to Fixed Deposits (FDs) and the real estate sector in several ways:

Compound Interest: Certain insurance policies, like participating life insurance plans, offer the potential for compounding returns. The bonuses declared by insurance companies on such plans can be reinvested, leading to the potential for higher returns over time compared to simple interest offered by FDs.

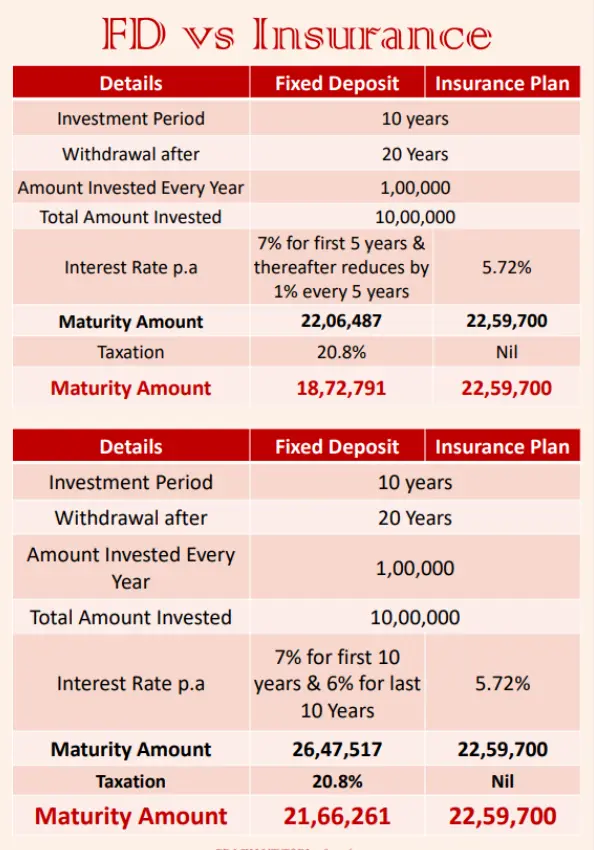

Additional Benefits: Insurance plans often come with additional benefits such as bonuses, loyalty additions, and maturity benefits. These can enhance the overall returns on the investment compared to FDs, which generally offer a fixed rate of interest.

Risk Coverage: Insurance plans provide risk coverage along with investment returns. In the case of an untimely demise of the insured, the nominee receives the sum assured along with any accrued bonuses or benefits, which can be significantly higher than the initial investment. This risk coverage is not provided by FDs or most real estate investments.

Tax Benefits: Certain insurance plans offer tax benefits on the premiums paid and the maturity proceeds under the Income Tax Act, providing additional returns in the form of tax savings. FDs also offer tax benefits, but insurance plans may offer more comprehensive tax benefits.

Long-Term Perspective: Insurance plans are typically long-term investment instruments, and the returns are often optimized over the long term. This long-term perspective can lead to higher effective returns compared to short-term investments like FDs.

Diversification: Investing in insurance can also provide diversification to an investment portfolio. By combining insurance with other asset classes like FDs and real estate, investors can spread their risk and potentially enhance their overall returns.

When comparing insurance to real estate investments, insurance offers several unique benefits:

Risk Protection: Insurance provides protection against various risks such as premature death, disability, critical illness, and property damage. This protection can offer financial security to individuals and families in the event of unforeseen circumstances.

Long-Term Financial Planning: Certain insurance products like life insurance or retirement plans are designed for long-term financial planning, providing benefits over an extended period. These policies can help individuals save for retirement, children's education, or other long-term goals.

Tax Benefits: Insurance premiums paid and the maturity amount received are eligible for tax benefits under the Income Tax Act, offering tax savings to policyholders. This can be advantageous for individuals looking to optimize their tax liabilities.

Flexibility in Premium Payment: Insurance policies often offer flexibility in premium payment terms, allowing policyholders to choose the frequency and mode of payment based on their convenience. This flexibility can suit individuals with varying income streams or financial circumstances.

Coverage for Critical Illnesses: Many insurance plans provide coverage for critical illnesses, offering financial support for medical expenses related to specific illnesses. This coverage can be crucial in managing healthcare costs during challenging times.

Loan Facility: Some insurance policies offer a loan facility against the policy's surrender value, providing liquidity when needed. This feature can be beneficial for policyholders who require funds for emergencies or other purposes.