In India, individuals may have multiple income sources, each subject to different tax considerations. The four primary categories under which an individual is taxed are 'Income from Salary,' 'Income from Capital Gains,' 'Income from House Property,' and 'Income from Business or Profession.' Any other income falls under the category of 'Income from Other Sources,' which includes earnings from savings and investments like interest on bank accounts or dividends from investments in India.

Who is an NRI?

A Non-Resident Indian (NRI) is an individual of Indian origin residing outside India for various reasons such as personal, business, employment, or education. NRIs may hold Indian or foreign citizenship. The Indian Income Tax Act defines NRIs based on their duration of stay in India, typically less than 182 days in a financial year or a total of 365 days or more in the preceding four financial years.

Interest and Dividend Tax for NRIs

- Interest earned on an NRE (Non-Resident External) or FCNR (Foreign Currency Non-Resident) account is tax-free.

- Interest on an NRO (Non-Resident Ordinary) account is fully taxable at applicable rates.

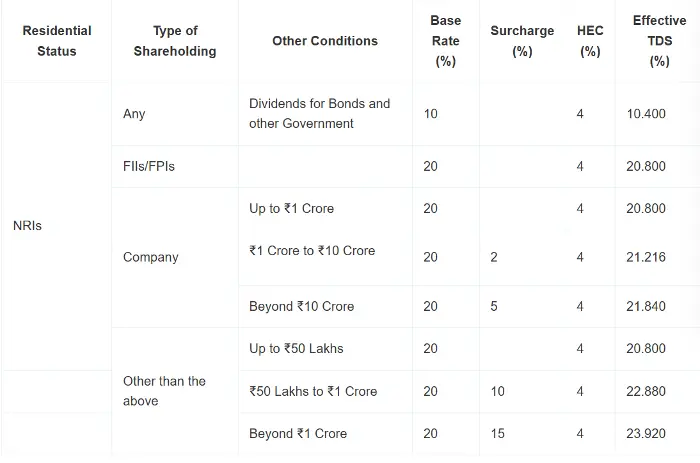

- Dividends earned on investments in Indian companies or mutual funds are subject to a 20% tax rate plus surcharge and cess, without deductions under Chapter VI-A of the Income Tax Act.

Disclosure and Tax-Saving:

- It's crucial to disclose income correctly in the Income Tax Return (ITR) form to avoid confusion and potential inquiries from tax authorities.

- Dividend income should be reported under 'Income Chargeable at Special Rates,' and income taxed under the Double Taxation Avoidance Agreement (DTAA) should be mentioned under 'Special Income.'

- Even tax-exempt income should be disclosed under 'Exempt Income.'

Tax-Saving Options

- NRIs can consider NRI life insurance plans offered by companies like NRInsured Insurance Agency, which provide insurance coverage along with tax benefits.

- These plans can be managed online for convenience.

Understanding the tax implications for NRIs investing in India is essential to comply with tax regulations and avoid penalties. By knowing how interest and dividends are taxed, NRIs can make informed decisions about their investments and ensure they file their taxes correctly.